Table of Contents

Meaning of section 234F:

As per section 139 (1) of the Income Tax Act, a person is required to file an income tax return on or before the due date, but if he does not file his income tax return within the stipulated time, then he has to pay late filing fee under section 234F. A late fee under section 234F depends on the time of filing an income tax return.

Following persons are covered under section 234F

- An individual whose total income exceeds the basic exemption limit.

- Any trust/institution whose income before application exceeds the basic exemption limit.

- Any company and firm.

Due date for filing income tax return

- Person whose books of account are not required to audit: 31st July

- Person whose books of account are required to audit: 31st October

Late filing fee u/s 234F (ITR filed after due date)

| Particulars | E-Filing Date | Late Fees |

| If total income exceed 250,000 but less than or equal to 500,000 | Between 1st August to 31st March | Rs 1000 |

| If total income exceed 500,000 | Between 1st August to 31st March | Rs 5000 |

Let us understand the late filing fee of section 234F with the following example

| Total Income | Filing Date | Late Fees u/s 234f | Reason |

| 480,000 | 20/06/22 | No late fees | Since the return is filed before the due date. |

| 395,000 | 10/10/22 | 1000 | Since total income is below 500,000. |

| 960,000 | 15/12/22 | 5000 | Since total income exceeds 500,000. |

How to pay the late fee of section 234F?

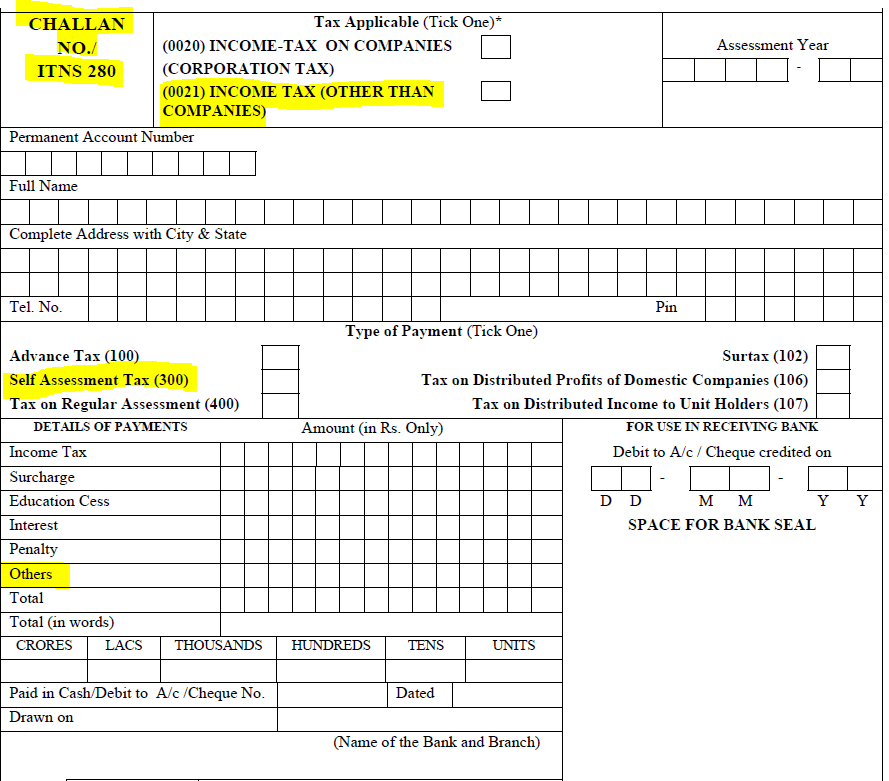

Fill in the following details in Challan No-280 to pay the late fee of section 234f :

Tax applicable – Income-tax (other than companies) (0021)

Type of payment – Self-assessment (300)

Details of payment – Fill amount in “other”

Frequently Asked Questions

Q-1 Can the late fees of section 234F be waived?

Ans. No, the Taxpayer has to pay the late fee of section-234f.

Q-2 Can we adjust excess TDS deducted towards the fees u/s 234f?

Ans. Yes, the Income tax department can adjust excess TDS deducted towards payment of late fees of section 234F.

Q-3 Is section 234f a fee or a penalty?

Ans. As per Income Tax Act, the amount of section 234f is a fee not a penalty. Because it automatically applied after the due date.