Table of Contents

Employees’ State Insurance Corporation

Applicability:

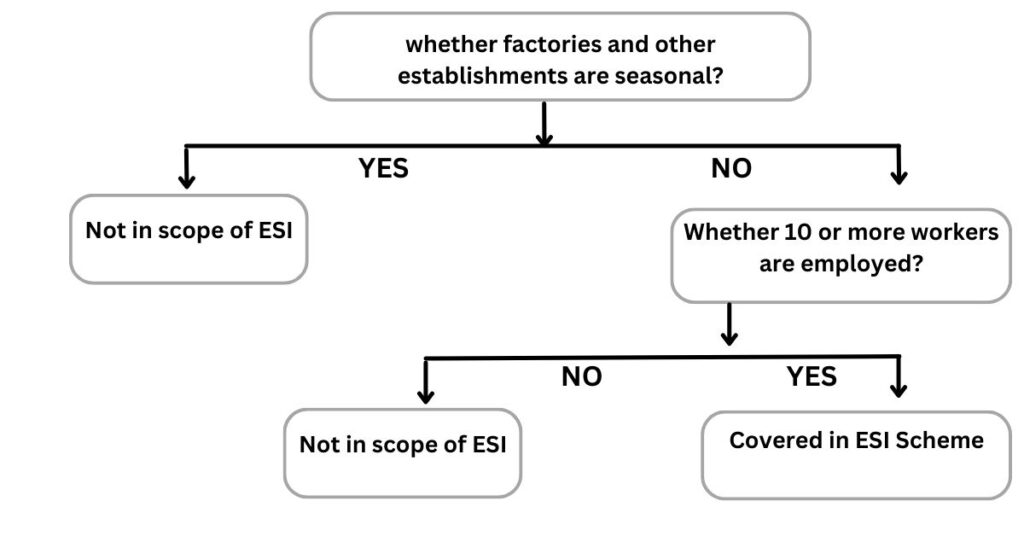

Employees’ state insurance corporation is a statutory body set under the ESI Act, 1948. ESI is applicable to all factories and other establishments where 10 or more persons are employed in such factories and other establishments, and the beneficiaries’ monthly salary does not exceed Rs. 21000.

Note: In Maharashtra, the limit of employees is 20.

Note: In Maharashtra, the limit of employees is 20.

Contribution:

The fixed contribution rate of ESI (F.Y 2023-24)

For Employee – .75 %

For Employer – 3.25 %

Contribution Period:

There are two contribution periods: First – 1st April to 30th September

Second – 1st Oct to 31st March

If the salary of an employee exceeds the limit of 21000 during the above contribution period, then ESI will be deducted till the end of that contribution period.

Example: The salary of Mr. X was 18000 till June 2022 and from July 2022 salary was increased to 22000.

Solution: Here the contribution period is from 1st April 2022 to 30th September 2022. Hence deduction will continue on the revised salary up to September.

Employees’ Provident Fund

Employees’ provident fund and Miscellaneous Act, 1952 established the Employees’ provident fund which is a saving scheme.

Applicability:

If any factory and establishment employed 20 or more employees must register with the EPF scheme.

Contribution:

- For Employees:

1. EPS – 0 %

2. EPF – 12% - For Employers:

1. EPS – 8.33 % (of the 12 %)

2. EPF – 3.67 % (of the 12 %)

* EPS – Employee Pension Scheme

EPF – Employee Provident Fund

Note: Contributions are payable on a maximum wage ceiling of 15000.

Note: Pension contribution is not to be paid when an employee crosses 58 years of age.