What are journal Entries?

We use accounting journal entries to record every business transaction in the accounting record of business. Journal entry records every business transaction at two places which is also known as a double entry accounting system. For example, when we sell goods in cash, this increases our revenue account and cash account.

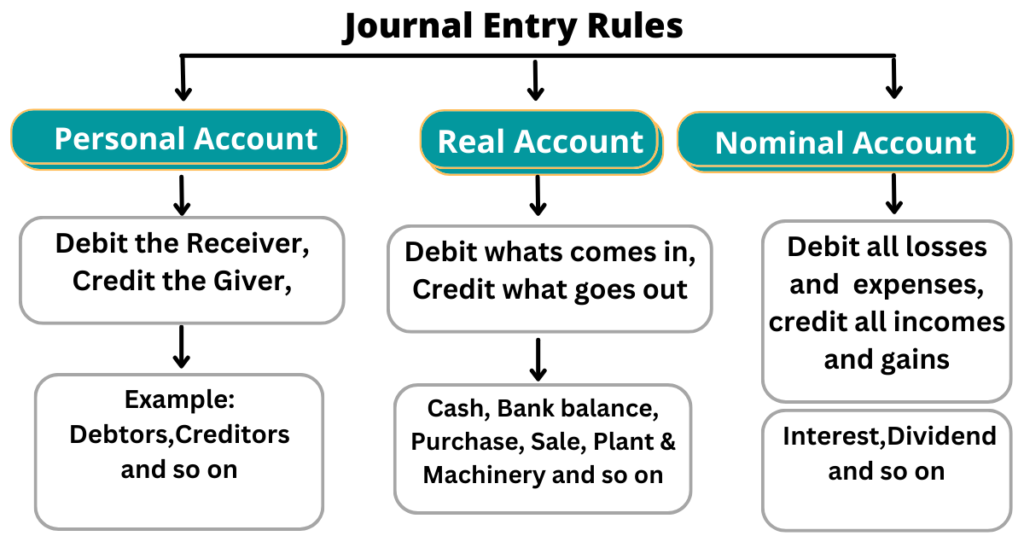

Journal Entry Rules

The Most Common Entries

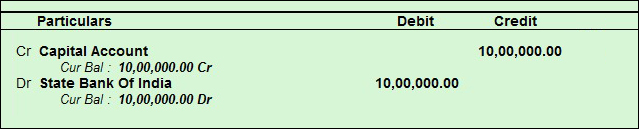

1. Journal entry for introducing capital into business:

When an owner invests capital into a business, we record following entry.

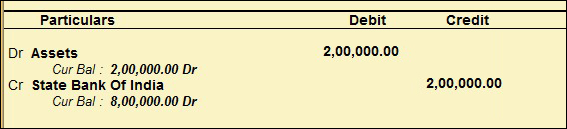

2. Journal entry for purchasing assets:

In this entry, the owner spends some money to obtain assets.

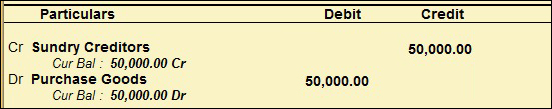

3. Journal entry for purchasing goods on credit:

Under this entry, we record purchased goods on credit.

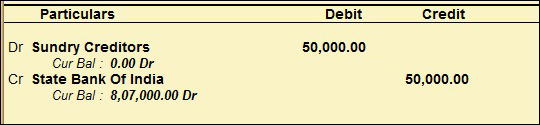

4. Journal entry for making payment to creditors:

When we make payments to creditors, we enter the following entry.

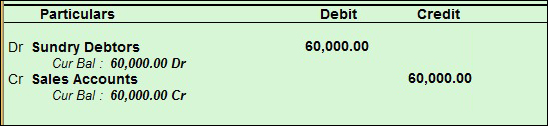

5. Journal entry for selling goods on credit:

Selling goods on credit, we enter the following entry.

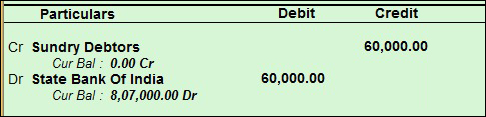

6. Journal entry for receiving the amount from debtor:

When we receive an amount from the debtor, we enter the following entry.

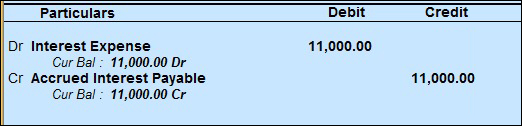

7. Journal entry for interest expense accrued:

For recording interest expenses accrued, we enter the following entry.

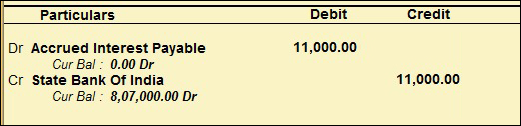

8. Journal entry for interest expenses paid in cash:

When we pay accrued expenses, we enter the following entry.

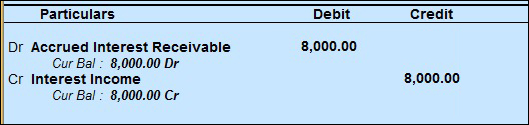

9. Journal entry for interest income accrued:

For recording interest income accrued, we enter the following entry.

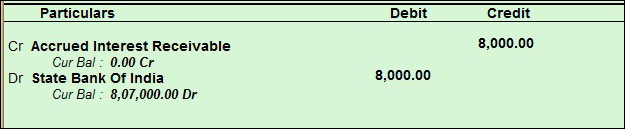

10. Journal entry for receiving income in cash:

When we receive accrued income, we enter the following entry.

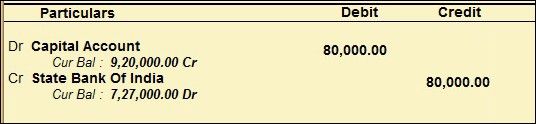

11. Journal entry for withdrawing owner’s capital

When we withdraw capital from a business, we enter the following entry.