If a person earns profit from intraday and F&O trading, the first question that comes into mind is how to report intraday and F&O trading income.

In this post, you will get the answer to the following questions:

- How to report intraday and F&O trading income/loss?

- Which ITR will be applicable for salaried persons engaged in intraday and F&O trading?

- Can traders show their trading income under section 44AD (presumptive scheme)?

- For how many years can we carry forward F&O losses? etc.

Table of Contents

Meaning of intraday equity & F&O trading

Under Intraday Equity Trading, Intraday equity traders buy and sell the stocks and earn profits through price fluctuation on the same day. The profits or losses earned from intraday equity trading are considered speculative business income/losses.

Intraday equity trading is speculative activity as traders do trading without the intention of taking delivery of shares.

Under Future & Option, Two parties enter into a contract to buy or sell stock or index at a fixed price. The profits/losses earned from F&O trading are considered non-speculative business income/Losses.

F&O trading is non-speculative activity as traders do for hedging purposes.

Which ITR to file for reporting of intraday and F&O trading income?

A person who earned profit or incurred losses from intraday equity trading or F&O trading will file a return of income through ITR-3 or ITR-4. Even a salaried person engaged in intraday equity trading or F&O trading will also file his return of income through ITR-3 instead of ITR-1 or ITR-2.

Reporting of intraday and F&O trading Income as business income

All traders do their trading through brokers, and brokers maintain their client’s books of accounts. Hence traders can not declare their income under “No Account Case” in ITR-3.

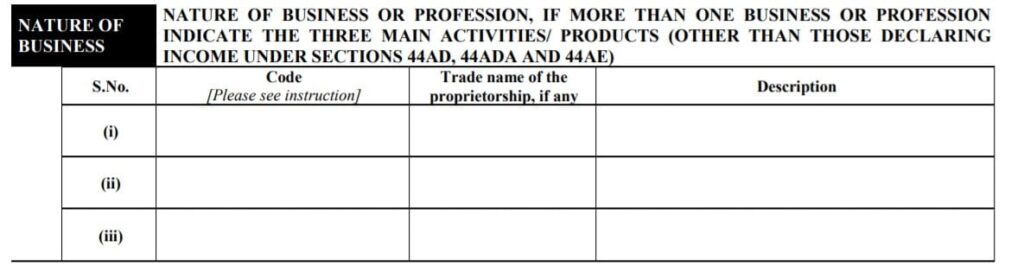

Step-1 Nature of business: There is no specific code for intraday equity or F&O trading in ITR-3, but you may choose code 09028- Retail sale of other products.

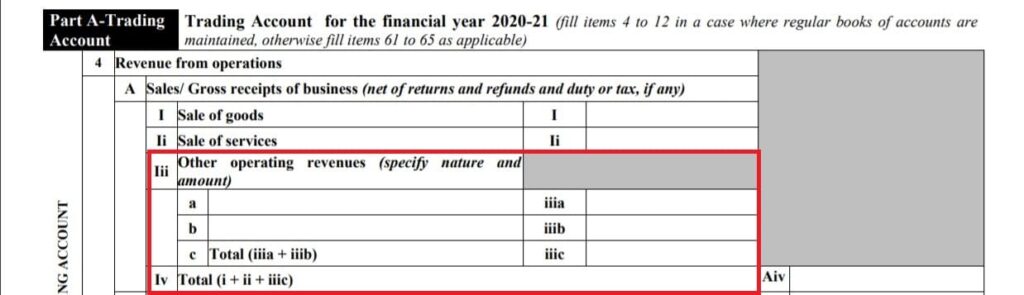

Step-2 Trading Account: Enter intraday equity and F&O trading details into Trading Account under:

“Other Operating Revenue” section-

- Turnover from F&O

- Turnover from Intraday Equity

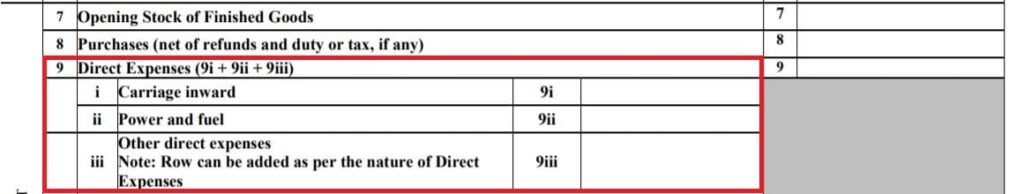

“Other Direct Expense” Section-

- Purchase value from F&O

- Purchase value from intraday

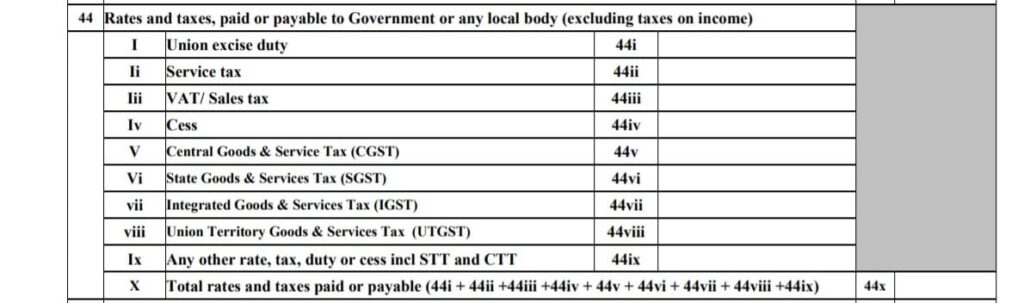

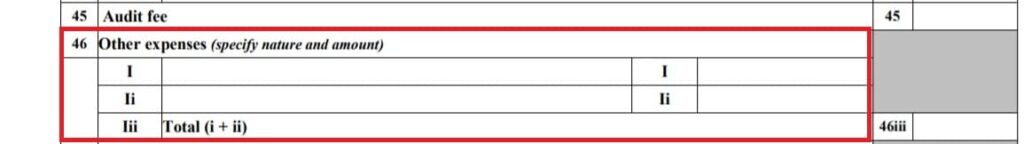

Step-3 Profit and Loss Account: Enter expenses related to intraday equity and F&O trading Under:

“Rate and Taxes paid or Payable to Govt.

- IGST

- CGST

- SGST

“Other Expense” section-

- Brokerage Expenses

- Exchange Transaction charges

- SEBI Turnover Fees

- Security Transaction Tax

A person can also claim other expenses. ( like internet expenses, telephone expenses, professional advisor fees, etc.)

Other things in ITR-3 will remain the same.

Claim expenses related to intraday and F&O trading

If a person declares his intraday equity or F&O income under the business head can claim expenses exclusively spent on the business. (Expenses like internet expenses, telephone bills, brokerage, consultant fees, etc.)

Note: Maintain a proper record of bills/receipts and make sure that you make payments via cheques or electronic mode.

As per section 40A(3) of the Income Tax Act 1961, expenditure incurred in cash over Rs 10,000 in a single day shall not be allowed as a deduction.

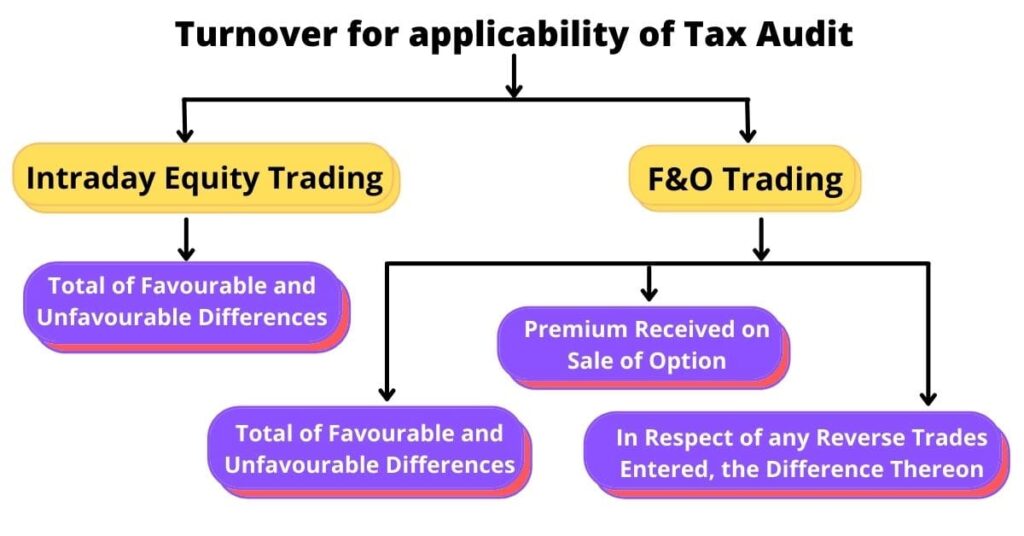

Determination of turnover of intraday equity and F&O trading

Intraday equity turnover (Speculative Transactions)

Aggregate all the positive and negative differences from trade to calculate intraday equity turnover.

Example:1 If you buy 100 shares of ITC at 200 in the morning and sell at 220 by evening.

Solution: The profit or positive difference is 100 x 20 = Rs 2000. Hence the positive difference of Rs 2000 will be considered as turnover.

Example:2 If you buy 100 shares of Tata Motors at 500 in the morning and sell at 490 by evening.

Solution: The loss or negative difference is 100 x 10 = Rs 1000. Hence the negative difference of Rs 1000 will be considered as turnover.

F&O Turnover (Non-speculative transaction)

The sum of the following will be taken as F&O turnover.

- all favorable and unfavorable differences, and

- Premium received on sale of an option, and

- In respect of any reverse trade entered, the difference thereon.

Example:1 In the future contract, if you buy 1 lot (25 units) of nifty futures at 17000 and sell at 16800.

Solution: The loss or negative difference of 25 x (16800-17000)= Rs -5000 will be taken as turnover.

Example:2 In the option contract, if you buy 4 lots (100 units) of nifty 17200 call at Rs 70 and sell at Rs 110.

Solution: The profit or positive difference is 100 x (110-70) = Rs 4000 and the premium received on sale is Rs 110×100= Rs 11000. Now total turnover is Rs 4000 + Rs 11000 = Rs 15000.

Maintenance of books of accounts

A person runs a business in the capacity of an individual or HUF. Such a person needs to maintain books of account if his income exceeds Rs 2.5 lakhs or turnover exceeds Rs 25 lakhs in any three preceding years or the first year in case of new business.

If a person has engaged in Intraday equity or F&O trading, the provisions also apply for such a person.

In the case of Intraday Equity or F&O, books of accounts include trading accounts, expense receipts, payment bills, and bank statements. A person needs these documents for making a profit and loss account.

Applicability of audit

- As per Normal Provisions: If a person is running a business and turnover exceeds Rs 1 crore, such person has to get his accounts audited by CA and submit an audit report along with your tax return. W.e.f. 1-04-2021 government has increased the audit limit from Rs 5 crore to Rs 10 crore where cash receipts and cash payments do not exceed 5% of total receipts or payments. In other words, you can say that 95% of business transactions should be through banking channels.

- As per presumptive scheme: Under section 44AD(4), if a person has declared profit under the presumptive scheme in any five previous years. Now such a person declares losses or lower income than the rate mentioned in the presumptive scheme and total income after all deduction exceeds the maximum amount not chargeable to tax i.e. Rs 2.5 Lakhs. Such person shall be liable for audit as per section 44AB.

Provisions related to set-off and carry forward of losses

Set-Off:

- Non-speculative business losses can be set off against the income of any head except the salary head.

- Speculative business losses can be set off only against profit from speculative business.

Carry Forward:

- Non-speculative business losses can be carried forward up to the next eight assessment years from the assessment year in which it incurred.

- Speculative business losses can be carried forward up to the next four assessment year from the assessment year in which it incurred.

Note: If a person fails to file the return of income within the due date, such person can not carry forward the above losses.

Frequently Asked Questions:

Q-1 What is the business code for intraday equity or F&O trading?

Ans.- There is no specific code for intraday or F&O trading in ITR-3, but you may choose 09028- Retail sale of other products. 09028 is the best code to show intraday equity or F&O trading income,

Q-2 Is tax audit compulsory for F&O loss?

Ans: A person doesn’t need a tax audit for F&O loss except where a person declares his income under the presumptive scheme in any previous five years and later years declares loss or lower income than the rate mentioned in the presumptive scheme. Such a person needs to get audited his books of account as per section 44AB.

Respected Sir,

How to fill balance sheet in above case i.e. only capital gains + Intra day + F&O AND no other business. Qualified for Accounts Maintenance. But, no business assets.

Thank you for your comment,

I’ll consider your query in the next post.